Corporate governance

Daido Steel views corporate governance as one of the key issues for management in today’s rapidly changing business environment.

We strive to increase management efficiency, accelerate and improve decision-making, and ensure management transparency. In addition to the Daido Steel Group Management Philosophy and Conduct Guidelines, the Company has established the Daido Steel Corporate Code of Ethics to clarify its responsibilities as a corporation that contributes to society. Through these measures, the Company endeavors to maintain its foundation as a corporation that is open to society.

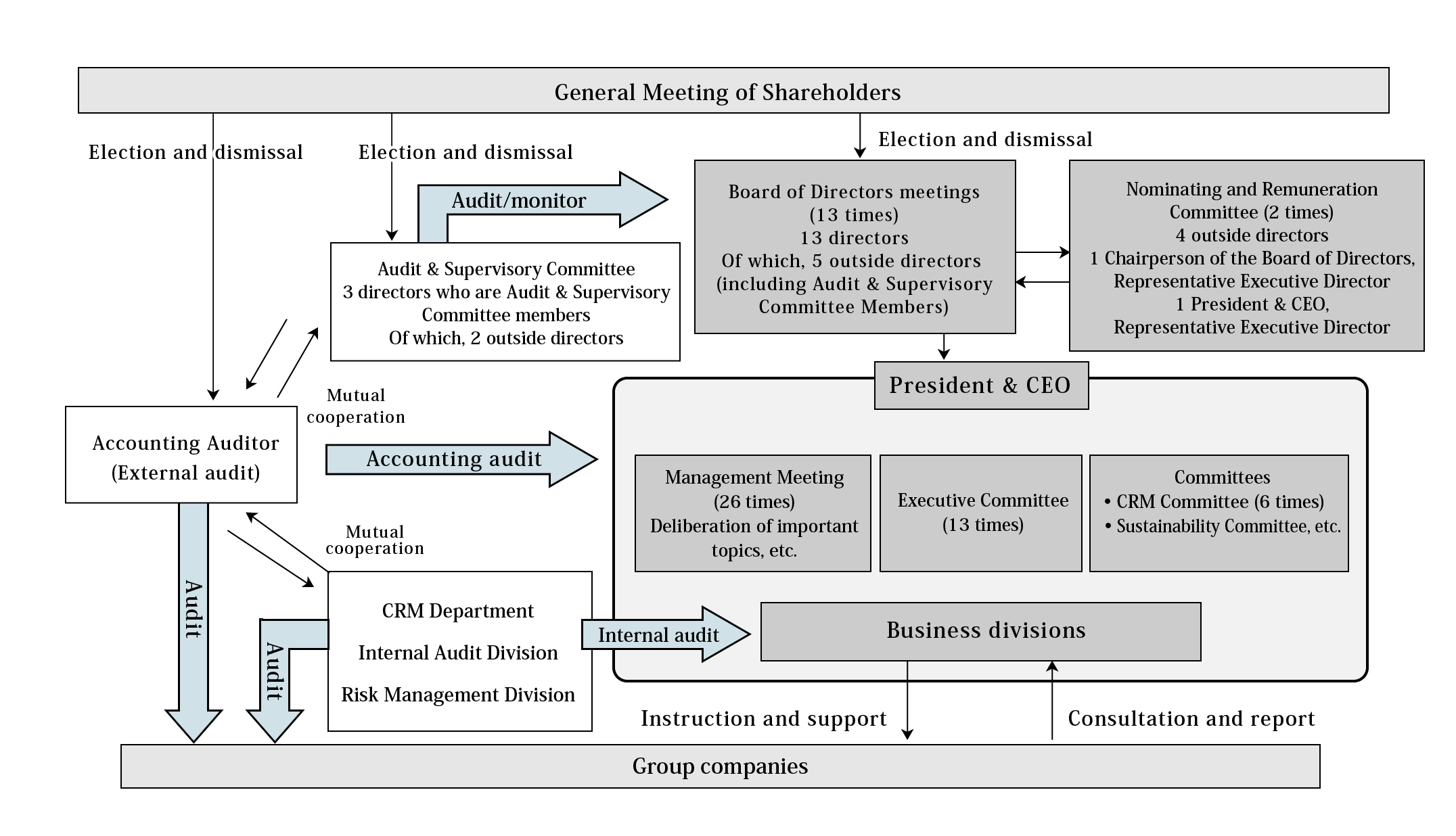

Governance system

Daido Steel made the transition to a company with an Audit & Supervisory Committee in June 2022 for the purpose of speeding up management decisions, enhancing medium- to long-term corporate value, and further strengthening the governance system.

With the transition to a company with an Audit & Supervisory Committee, part of the execution of operations that was a matter to be discussed by the Board of Directors has been delegated to the President in an effort to increase medium-to long-term corporate value by speeding up decision making and focusing the content of deliberation in the Board of Directors on management policy and management strategy.

In order to secure a system that enables supervision and monitoring, the delegated matters are deliberated in the Management Meeting attended by directors who are full-time Audit & Supervisory Committee members or in the committee, depending on the contents of the matters to be discussed.

Furthermore, efforts are made to further strengthen the Board of Directors’ governance of management by giving directors who are Audit & Supervisory Committee members the right to vote in the Board of Directors. The state of Daido Steel’s corporate governance is disclosed in the Corporate Governance section of the Company’s website

| Organization format | Company with an Audit & Supervisory Committee |

|---|---|

| Number of members of the Board of Directors pursuant to the Articles of Incorporation | 19 |

| Chairperson of Board of Directors | Chairperson (except when concurrently serving as President) |

| Term of directors who are not Audit & Supervisory Committee members | 1 year |

| Term of directors who are Audit & Supervisory Committee members | 2 years |

| Number of directors | 13 |

| Election of outside directors | Yes |

| Number of outside directors | 5 |

| Number of outside directors designated as independent officers | 5 |

(Note)

CRM Committee: Corporate Risk Management Committee

CRM Department: Corporate Risk Management Department

Figures in parentheses indicate the number of meetings held in fiscal 2021. Figures are not shown for the Audit & Supervisory Committee or the Sustainability Committee because they were newly established in fiscal 2022.

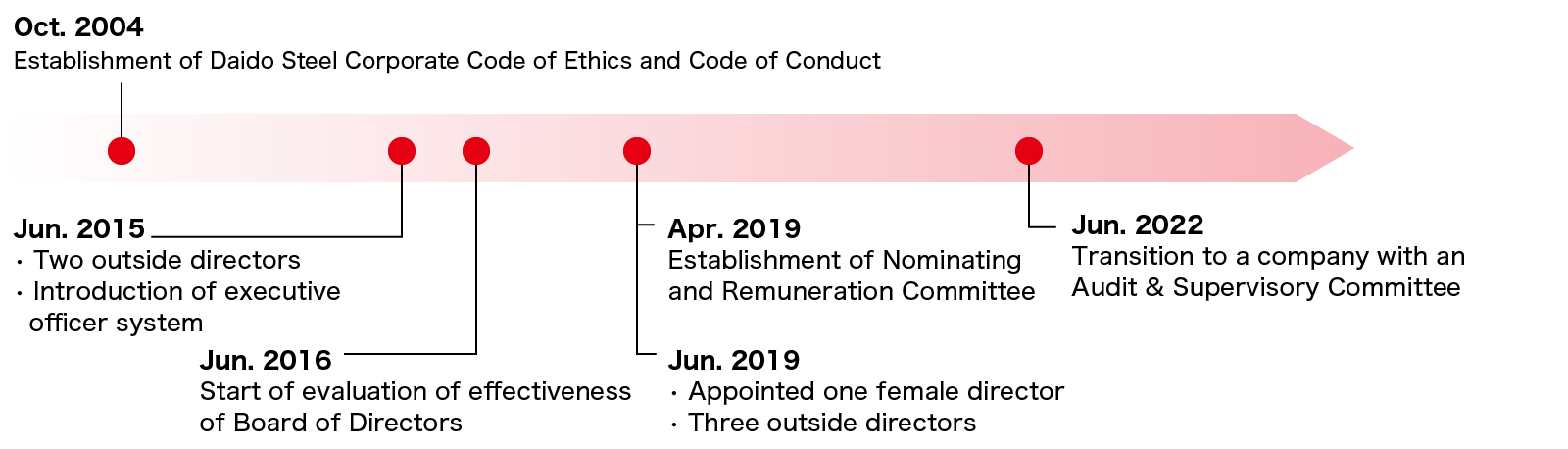

Progress in strengthening of corporate governance

Initiatives aimed at improvement of effectiveness of Board of Directors

We are carrying out the following initiatives to increase the effectiveness of the Board of Directors.

- By delegating part of the execution of operations to the President, the content of deliberation in the Board of Directors is limited management planning and management strategy, and we are working to strengthen supervisory functions and striving to increase medium- to long-term corporate value

- We are striving to encourage active discussion in meetings by sending materials on matters to be discussed by the Board of Directors to outside officers in advance to provide them with a deeper understanding.

- Meetings for exchanging opinions with outside officers apart from the Board of Directors are arranged when deeper discussion is required. Efforts are made to make the Board of Directors productive by referring to the opinions raised in meetings to exchange opinions

Evaluation of Effectiveness of the Board of Directors

Daido Steel has performed an evaluation of the effectiveness of the Board of Directors once every year since 2016 by conducting a survey of all directors. The content of the survey is made up of I. effectiveness of discussion and consideration, II. effectiveness of supervisory function, III. effectiveness of leadership, IV. effectiveness of establishment of environment, V. effectiveness of responses to shareholders and stakeholders, and VI. effectiveness of composition, etc. of the Board of Directors (28 questions). The analysis and evaluation results based on the survey are reported to the Board of Directors.

In fiscal 2020, supervision of operation of the internal reporting system, succession planning for CEO and others and feedback of opinions of shareholders were mentioned as issues.

Improvements were made to address supervision of operation of the internal reporting system by reviewing the content of reports in the Board of Directors. Issues remain with succession planning for CEO and others and feedback of opinions of shareholders, and we will continue to endeavor to make improvements.

We plan to take the following action in fiscal 2022 to address the issues identified based on the results from fiscal 2021

- Review of succession planning for CEO and others

- Strengthening of IR activities and timely and appropriate feedback to the Board of Directors

Going forward, we will continue to strive to improve effectiveness by revising the questions according to changes in the environment while referring to the opinions provided.

Status of officers (Director skill matrix)

| ESG Management/ Planning |

Manufacturing Technology /R&D |

Sales /Marketing |

Finance /Accounting |

IT | Overseas Business |

Legal/ Compliance |

|

|---|---|---|---|---|---|---|---|

| Tadashi Shimao | 〇 | 〇 | 〇 | 〇 | |||

| Takeshi Ishiguro | 〇 | 〇 | 〇 | ||||

| Tsukasa Nishimura | 〇 | 〇 | 〇 | ||||

| Tetsuya Shimizu | 〇 | 〇 | 〇 | ||||

| Kazuhiro Toshimitsu | 〇 | 〇 | |||||

| Toshiaki Yamashita | 〇 | 〇 | |||||

| Akihito Kajita | 〇 | 〇 | 〇 | 〇 | |||

| Shuji Soma | 〇 | 〇 | 〇 | ||||

| Ryoichi Yamamoto | 〇 | 〇 | |||||

| Mutsuko Jinbo | 〇 | 〇 | |||||

| Susumu Shimura | 〇 | 〇 | 〇 | ||||

| Kiyoshi Mizutani | 〇 | 〇 | 〇 | 〇 | 〇 | ||

| Kenji Matsuo | 〇 | 〇 | 〇 |

- Skills forming the basis for corporate management

- ESG Management/Planning

- Manufacturing Technology/R&D

- Sales/Marketing

- Finance/Accounting

- Skills that are essential for future business operation and will be focused upon

- IT

- Overseas Business

- Skills required in non-financial aspects

- Legal/Compliance

Ensuring Diversity of the Board of Directors

Directors are elected from the perspective of being able to deal with management of and issues in each business, and being able to make decisions based on exchanging diverse opinions for the improvement of effectiveness of the Board of Directors. At present, Daido Steel emphasizes not only knowledge, experience and skills and a global perspective, but also ensuring diversity in terms of gender, age and career history, including for outside directors, to have a very well balanced composition.

Officer remuneration

- Policy

Remuneration of officers is paid in cash as monthly remuneration and bonuses.

A Policy for Determination of Individual Remuneration of Directors (Excluding Directors Who are Audit & Supervisory Committee Members) (hereinafter, “Determination Policy”) has been specified, the individual remuneration of directors (excluding directors Who are Audit & Supervisory Committee members) is paid in accordance with this. The details of the Determination Policy are as follows.

Monthly remuneration

This is calculated based on the remuneration table within the scope of the monthly limit on remuneration specified in the Shareholders’ Meeting. Remuneration of directors (excluding directors who are Audit & Supervisory Committee members) is made up of (a) a fixed part for each position and (b) a performance-linked part. Remuneration tables are specified for each position, and the percentage of payment of the performance-linked part is designed to be larger for higher positions according to their duties. Consolidated ordinary income is used as the indicator for performance-linked remuneration. Remuneration of outside directors (excluding directors who are Audit & Supervisory Committee members) is made up of only (a) a fixed part for each position.

Bonuses

These are 100% performance-linked to provide an incentive for improving performance, and non-consolidated ordinary income is used as the indicator for performance.

Remuneration of directors who are Audit & Supervisory Committee members is determined based on discussion in the Audit & Supervisory Committee

Amount of remuneration (fiscal 2021)

| Officer type | Total amount of remuneration (Millions of yen) |

Total amount of remuneration by type (Millions of yen) | Number of officers included |

|

|---|---|---|---|---|

| Fixed remuneration | Performance-linked remuneration |

|||

| Directors (excluding outside directors) | 343 | 229 | 113 | 7 |

| Audit & Supervisory Board Members (excluding outside Audit & Supervisory Board Members) | 29 | 29 | – | 1 |

| Outside officers | 69 | 69 | – | 6 |

Cross-Shareholdings

- Cross-Shareholdings Policy

We believe that cooperative relationships with related companies are essential in all areas of business conducted by the Company, such as procurement of raw materials and others, development, manufacture and sale of products, and stable supply. To achieve sustained growth in future, we believe it is necessary to maintain relationships of trust with stakeholders and increase medium- to long-term corporate value. Therefore, our basic policy is to reduce cross-shareholdings as a whole while only continuing appropriate holdings in light of the perspective of increasing corporate value.

- Review of Cross-Shareholdings

Every year, Daido Steel reviews the purpose and appropriateness of individual cross-shareholdings in the Board of Directors. The appropriateness of holdings is reviewed by performing a quantitative review of financial stability, share price and dividends of the portfolio company, and a qualitative evaluation of the importance in Daido Steel’s business by considering the amount sold to or from the portfolio company, the amount of profit and the amount of financial transactions. Holdings will be reduced if not found to be appropriate according to the conditions in future.

In the 2023 Medium-Term Management Plan, we decided to reduce the amount of cross-shareholdings (excluding deemed shareholdings) to 20% or less of net assets with an aim to reduce it to 10% in the long term. In fiscal 2021, which was the first year covered by the plan, we reduced holdings of six stocks by ¥7.4 billion, bringing the amount of cross-shareholdings (excluding deemed shareholdings) to 20% or less of net assets to 18.8%. And then, by the end of 2023, we intend to make a further reduction aiming to lower cross-shareholdings including deemed shareholdings to 20% or less of net assets.

- Voting Criteria

Daido Steel exercises its voting rights by making comprehensive decisions based on the issuing company not performing antisocial acts, whether the proposal will contribute to enhancing the medium- to long-term corporate value of the issuing company, and the impact on the Company.